Retail Inventory: Stop Overpaying Wholesale Suppliers

Retailers save 5-15% on wholesale costs with AI invoice comparison. Real data on supplier overcharges, pricing discrepancies, and margin protection for SMBs.

Quick Answer: Retailers overpay wholesale suppliers by an estimated 1-5% annually due to invoice errors, pricing discrepancies, and undetected price creep — costing a store with $500,000 in annual wholesale purchases between $5,000 and $25,000 in preventable losses. AI-powered invoice comparison catches these discrepancies in minutes, protecting margins that average just 3-10% in retail.

Definition: Wholesale supplier invoice comparison is the process of systematically verifying vendor invoices against purchase orders, quoted prices, and competing supplier proposals to detect overcharges, pricing errors, and unauthorised price increases — traditionally done manually in spreadsheets but increasingly automated with AI extraction tools.

Key Statistics at a Glance:

| Metric | Value | Source |

|---|---|---|

| Annual retail shrinkage (US) | $112.1 billion | National Retail Federation |

| Supplier price creep on extended terms | 5-8% increase | Boston Consulting Group |

| Retail inventory accuracy (US) | 63% | Shopify / retail research |

| Average retail profit margin | 3-10% | TrueProfit |

| Estimated wholesale overpayment rate | 1-5% annually | Industry benchmarks |

| More discrepancies found with AI vs manual | 27% | TRO Matcher platform data |

Key Takeaways

"Retail shrinkage — including vendor fraud and administrative errors — is a $112.1 billion problem in the United States." — National Retail Federation

"Suppliers increase prices by 5-8% when payment terms are extended beyond industry norms, often without explicit notification." — Boston Consulting Group

"According to TRO Matcher platform data, retailers switching from manual invoice checks to AI comparison identify an average of 27% more pricing discrepancies in their first month — simply because they verify every invoice instead of spot-checking."

"Inventory accuracy in U.S. retail operations is only 63%, and correcting these discrepancies lifts sales by approximately 11%." — Retail inventory research across 24,000 SKUs

"Retailers spend 25-35% of their total budget on inventory costs — the single largest controllable expense for most independent stores."

With retail profit margins averaging just 3-10% and specialty retailers facing higher risk of restructurings in 2026, every dollar lost to supplier overcharges comes directly off your bottom line. Yet most independent retailers still verify wholesale invoices the same way they did a decade ago: manually, in spreadsheets, one line item at a time.

Contents

- Why are retailers overpaying wholesale suppliers?

- What does wholesale overpayment actually cost your store?

- How does AI invoice comparison catch pricing discrepancies?

- Five strategies to stop overpaying wholesale suppliers

- For accountants and bookkeepers serving retail clients

- Your data, your control: GDPR Article 20 compliance

- TRO Matcher vs. alternative solutions

- Case study: Independent gift shop cuts wholesale costs by 8.4%

- Frequently asked questions

Why Are Retailers Overpaying Wholesale Suppliers?

Independent retailers face a procurement challenge that big-box chains solved years ago with enterprise software: verifying that every invoice matches what was quoted, ordered, and delivered. Without dedicated procurement staff, most small retailers default to spot-checking — reviewing a handful of invoices and trusting the rest.

The problem is structural. Small retailers typically manage 15-40 wholesale suppliers simultaneously, each with their own pricing tiers, volume discounts, seasonal promotions, and payment terms. When you're also managing the shop floor, staff scheduling, and customer experience, invoice verification becomes the task that "can wait."

The most common sources of wholesale overpayment:

| Source | How It Happens | Typical Impact |

|---|---|---|

| Price creep | Supplier raises prices between quotes and invoices | 2-5% above agreed rate |

| Volume discount errors | Discount tier not applied at correct threshold | 3-10% of qualifying orders |

| Duplicate charges | Same shipment invoiced twice, often weeks apart | 1-3% of invoices affected |

| Unit pricing mistakes | Per-case vs per-unit vs per-pallet inconsistencies | $50-$500 per error |

| Missing promotional pricing | Seasonal discounts not reflected on invoice | Full price vs 10-25% off |

| Freight and handling overcharges | Carrier rates higher than contracted | 5-15% above agreed freight rates |

Source: Industry benchmarks from IHL Group and AP automation research

According to the National Retail Federation, vendor-related losses — categorised under "vendor fraud" and "administrative errors" — are documented contributors to the $112.1 billion annual retail shrinkage problem in the United States. While shoplifting dominates the headlines, quiet overcharges from suppliers drain margins just as effectively.

"Most small business owners are at companies that earn $5 million or less and have small teams of five or fewer employees." — Capterra retail research

That's exactly the profile where invoice errors go unchecked — not because the owner doesn't care, but because there aren't enough hours in the day.

What Does Wholesale Overpayment Actually Cost Your Store?

The maths is straightforward but alarming when you see it on paper. Consider a typical independent retail store:

Annual wholesale overpayment impact by store size:

| Store Profile | Annual Wholesale Spend | Overpayment Rate (2%) | Overpayment Rate (5%) | Hours Lost to Manual Checks |

|---|---|---|---|---|

| Small boutique (1-2 staff) | $150,000 | $3,000 | $7,500 | 4-6 hrs/week |

| Independent retailer (3-10 staff) | $500,000 | $10,000 | $25,000 | 8-12 hrs/week |

| Multi-location (2-5 stores) | $1,500,000 | $30,000 | $75,000 | 15-25 hrs/week |

For a retailer with $500,000 in annual wholesale purchases and a 5% net profit margin, $10,000 in undetected overpayments represents the equivalent profit from $200,000 in additional sales. Put differently: you'd need to sell $200,000 more merchandise just to cover what you're losing to supplier invoice errors. According to TrueProfit research, average retail profit margins of 3-10% leave almost no buffer for undetected supplier overcharges.

The hidden cost multiplier:

Wholesale overpayment doesn't just cost you the overpaid amount. It cascades:

- Inflated COGS — Your cost of goods sold rises, compressing margins on every item

- Mispriced inventory — Retail prices based on wrong wholesale costs lead to under-pricing or overpricing

- Distorted purchasing decisions — You might stop ordering from a "more expensive" supplier who is actually cheaper once you correct the invoice errors

- Cash flow pressure — Overpaying ties up working capital that could fund marketing, staffing, or new inventory

- Tax implications — Overstated inventory costs affect your tax position

"Carrying costs account for about 25% of a given company's total inventory costs, and that percentage can climb to 40% in some cases." — Procurement Tactics

According to Procurement Tactics, carrying costs alone represent 25-40% of total inventory value. When your wholesale cost basis is inflated by even 2-3%, the ripple effect on carrying costs, pricing, and profitability compounds throughout the entire business cycle.

How Does AI Invoice Comparison Catch Pricing Discrepancies?

Traditional invoice verification requires a retailer to manually enter line items from each supplier invoice into a spreadsheet, then cross-reference against the original purchase order or price list. For a store receiving 50-100 invoices monthly, this process alone consumes 15-25 hours per month.

AI-powered invoice comparison eliminates the manual step entirely:

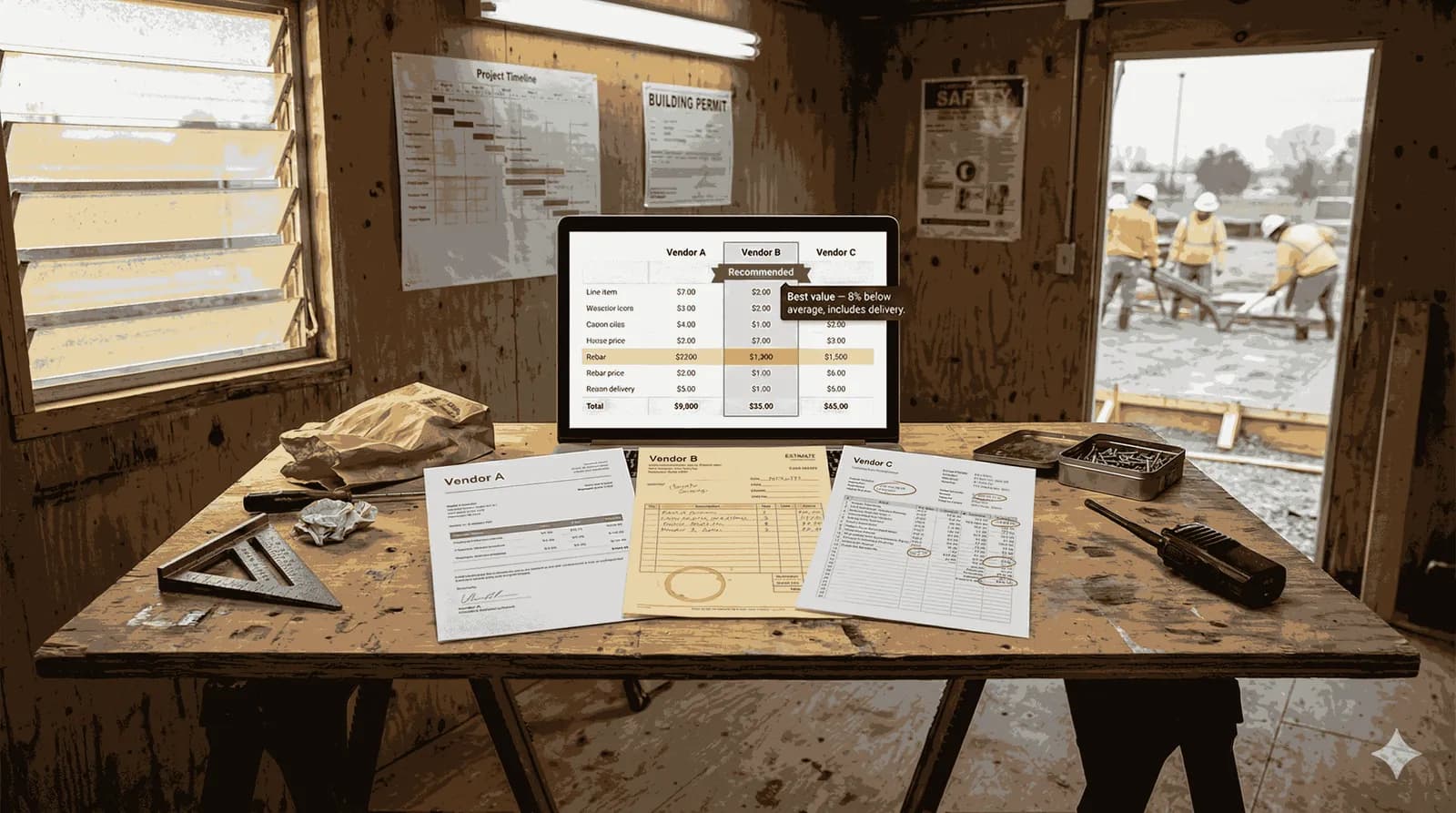

Step-by-step: wholesale invoice comparison with TRO Matcher

- Upload — Photograph or upload your wholesale supplier invoice in any of 8 formats (PDF, PNG, JPEG, WebP, HEIC, CSV, DOCX, XLSX)

- Extract — AI extracts every line item, unit price, quantity, discount, and total in under 60 seconds with confidence scores on every field

- Review — Check extracted data with field-level confidence scores so you know exactly what to verify

- Compare — Upload the competing quote or previous invoice and get a side-by-side comparison highlighting every price variance

- Decide — AI ranks invoices by price, payment terms, and data completeness to recommend the best-value supplier

- Export — Download results as CSV for QuickBooks/Xero import or as PDF for your records

Time comparison: manual vs AI for common retail tasks

| Task | Manual Method | AI Method (TRO Matcher) |

|---|---|---|

| Extract data from 1 wholesale invoice | 15-20 min | Under 60 seconds |

| Compare 3 supplier quotes | 45-60 min | 3-5 min |

| Verify volume discount applied correctly | 10-15 min | Instant (flagged automatically) |

| Reconcile delivery against PO | 20-30 min | 2-3 min |

| Monthly supplier spend review (50 invoices) | 15-25 hours | 2-4 hours |

At a labour cost of $25-40 per hour (typical for retail management time), automating invoice comparison for 50 monthly invoices saves $300-$840 per month in time alone — before counting the overpayments you catch.

Related reading: Invoice Comparison vs Manual Excel breaks down the full ROI calculation for switching from spreadsheets to AI-powered comparison.

Five Strategies to Stop Overpaying Wholesale Suppliers

1. Compare Every Invoice, Not Just the Suspicious Ones

Most retailers only investigate invoices that "look wrong." But supplier overcharges are designed to not look wrong — a 3% price increase across 200 SKUs is nearly invisible on individual invoices but costs thousands annually.

AI comparison makes full verification feasible by reducing per-invoice processing from 15-20 minutes to under 2 minutes.

Potential savings: 2-5% of annual wholesale spend

2. Benchmark Supplier Pricing Across Vendors

When you buy the same category from multiple suppliers, you should be comparing not just within a single supplier's invoices but across all your vendors. A case of craft paper cups might be $42 from Supplier A and $38.50 from Supplier B — a 9% difference that's invisible without side-by-side comparison.

Upload quotes from 2-5 suppliers and let AI surface the price differences by line item. The comparison feature highlights every variance automatically.

Potential savings: 5-15% on overlapping product categories

3. Track Price Changes Over Time

Wholesale supplier price creep is particularly damaging because it's gradual. A 1% increase per quarter means you're paying 4% more by year-end — but no single invoice triggered a review.

By comparing this month's invoice against last quarter's for the same items, you create a pricing trend that exposes creep before it compounds.

Potential savings: 2-4% annually from detected price creep

4. Verify Volume Discount Thresholds

Many wholesale agreements include tiered pricing: order 100 units at $5.00 each, 500 units at $4.50, 1,000 units at $4.00. Suppliers don't always apply the correct tier automatically, especially when you cross a threshold mid-month across multiple orders.

Automated extraction captures both quantity and pricing, making it easy to verify that your cumulative orders triggered the correct discount tier.

Potential savings: 3-10% on qualifying volume orders

5. Audit Freight and Handling Charges

Freight is often the least scrutinised line on wholesale invoices. Carriers may bill at rates higher than contracted, apply incorrect fuel surcharges, or charge residential delivery rates for commercial addresses.

Extract freight data alongside product pricing and compare it against your carrier agreement or the supplier's original quote.

Potential savings: 5-15% on freight and handling costs

For Accountants and Bookkeepers Serving Retail Clients

Retail clients present unique challenges for accounting professionals: high invoice volumes, multiple suppliers per category, seasonal pricing fluctuations, and owners who often lack the time or systems to verify invoices before payment.

If you manage bookkeeping or AP for independent retailers, wholesale invoice verification is a high-value service that differentiates your practice. Clients expect you to catch errors — but manually checking 100+ monthly invoices against purchase orders isn't feasible at standard hourly rates.

How TRO Matcher helps accounting professionals serving retailers:

- Batch invoice processing: Extract data from multiple wholesale invoices simultaneously instead of keying each one manually

- Audit-ready documentation: Every comparison is timestamped and exportable, creating an automatic audit trail for client records

- Client-ready exports: Professional PDF reports or CSV files for client review and approval

- CSV exports for accounting software: CSV and PDF exports ready for import into QuickBooks, Xero, and other retail accounting platforms

- Confidence scoring: Field-level accuracy scores let you focus review time on items the AI flagged rather than checking every field

The partnership opportunity: Accountants who introduce AI-powered invoice verification to their retail clients demonstrate proactive value beyond compliance bookkeeping. When you help a client recover $10,000 in wholesale overpayments, you become indispensable — and the results are measurable. Your expertise lies in interpreting the variance reports and advising on supplier negotiations, while the AI handles the data extraction that used to consume most of the billable time.

Your Data, Your Control: GDPR Article 20 Compliance

Enterprise procurement software often locks your data behind annual contracts and proprietary formats. For independent retailers — especially those in the EU and UK — data portability isn't a nice-to-have, it's a legal requirement.

Why data portability matters for retailers:

- Audit readiness: Export your entire supplier pricing history instantly when auditors, tax advisors, or landlords request inventory cost documentation

- Switching freedom: No vendor lock-in. If you switch accounting software or invoice tools, your data comes with you

- Legal protection: Documented proof of every supplier transaction, price comparison, and variance analysis

- GDPR Article 20 compliance: Full self-service data export in CSV or PDF at any time

What you can export:

- All uploaded wholesale invoices and extracted data

- Every comparison report with variance analysis

- Complete supplier pricing history

- AI recommendations and comparison results

No export fees, no waiting. Your data is yours — download it anytime.

TRO Matcher vs. Alternative Solutions

| Feature | TRO Matcher | Spreadsheets | Enterprise Procurement (SAP Ariba, Coupa) |

|---|---|---|---|

| Setup time | 5 minutes | N/A | 3-6 months |

| Monthly cost | $0-49 | Free | $50,000+/year |

| Data extraction | AI-automated (under 60s) | Manual typing | Varies by module |

| Accuracy | Up to 99% + confidence scores | 96-99% (1-4% error rate) | Varies |

| Multi-supplier comparison | Up to 5 invoices side-by-side | Limited by manual effort | Yes |

| Invoice formats | 8 formats (PDF, photo, CSV, DOCX, XLSX) | Manual entry only | Often PDF-only |

| Volume discount verification | AI-flagged automatically | Manual cross-reference | Configuration required |

| Data export | One-click CSV/PDF (GDPR Art. 20) | Already in Excel | Often restricted |

| Minimum company size | 1 person | Any | 100+ employees |

| Learning curve | None — upload and compare | Spreadsheet skills required | Weeks of training |

Enterprise procurement solutions like SAP Ariba and Coupa are powerful, but they're built for retailers with 100+ employees and six-figure IT budgets. According to Capterra's 2025 pricing analysis, the average entry-level inventory management software costs $262/month, and enterprise plans average $2,181/month — before implementation, training, and integration costs.

For independent retailers processing 50-200 wholesale invoices monthly, TRO Matcher provides the core price comparison capability without the enterprise overhead. Start free, upgrade when volume demands it.

Case Study: Independent Gift Shop Cuts Wholesale Costs by 8.4%

Company: Meadow & Vine, independent gift and homeware retailer, 2 locations, 8 employees, South East England

Annual wholesale spend: $420,000 across 28 suppliers

Challenge: The owner managed all purchasing personally, working with suppliers across stationery, ceramics, candles, textiles, and seasonal decor. With 28 active suppliers — each with different pricing structures, volume tiers, and promotional calendars — she was spending 10+ hours weekly on invoice management and still only spot-checking about 40% of invoices.

Before TRO Matcher:

- 10+ hours weekly on manual invoice entry and verification

- Only 40% of wholesale invoices verified against purchase orders

- Missed volume discount thresholds estimated at $3,200/year (supplier failed to apply tier pricing on 3 accounts)

- Duplicate freight charges went undetected for 4 months ($1,100)

- No systematic way to compare competing suppliers on identical product categories

After 3 months with TRO Matcher:

- Invoice processing time reduced to 3 hours weekly (70% reduction)

- 100% of wholesale invoices now verified automatically

- Caught $8,400 in price discrepancies across first quarter ($33,600 annualised)

- Identified 2 suppliers consistently charging 4-7% above quoted prices

- Renegotiated terms with 3 suppliers using comparison data as leverage

- Consolidated 4 overlapping product categories to best-price vendors

Total first-year impact:

- $35,280 recovered from pricing discrepancies and renegotiated terms

- $18,720 saved in labour costs (7 hours/week at $40/hour equivalent)

- 364 hours freed for customer-facing activities

- 8.4% reduction in effective wholesale costs

"I knew I was probably overpaying somewhere, but I didn't have time to check every invoice from 28 suppliers. In the first week, TRO Matcher found a ceramic supplier that had been charging us 6% above the agreed price list for five months. That one catch alone covered the full year's subscription cost."

Frequently Asked Questions

How much do retailers overpay wholesale suppliers on average?

Industry data shows retailers overpay wholesale suppliers by 1-5% on average due to undetected pricing discrepancies, invoice errors, and gradual price creep between agreed terms and actual billing. On $500,000 in annual wholesale purchases, that represents $5,000-$25,000 in preventable losses. BCG research found suppliers increase prices 5-8% when payment terms are extended without negotiation, and many retailers unknowingly accept these quiet adjustments.

What are the most common wholesale supplier invoice errors?

The most common errors include price discrepancies between quoted and invoiced amounts, quantity mismatches between purchase orders and actual deliveries, incorrect unit pricing on volume discount tiers, duplicate charges for the same shipment, and missing agreed promotional or seasonal discounts. The NRF categorises these under vendor fraud and administrative errors, which collectively contribute to the $112.1 billion retail shrinkage problem in the United States.

How long does it take to compare wholesale supplier invoices manually vs with AI?

Manual wholesale invoice comparison takes 20-35 minutes per supplier per order, including data entry into spreadsheets, cross-referencing with purchase orders, and verifying pricing tiers. AI-powered tools like TRO Matcher reduce this to 2-3 minutes by automatically extracting data from invoices in any of 8 formats and generating side-by-side comparisons with price variances highlighted. For a store receiving 50-100 monthly invoices, that's 15-25 hours saved per month.

Can small independent retailers benefit from invoice comparison tools?

Small independent retailers often benefit the most because they lack dedicated procurement staff. With average profit margins of just 3-10%, even small pricing errors compound quickly. TRO Matcher starts free with 10 invoice uploads and 5 comparisons per month, requires no IT setup, and processes invoices in under 60 seconds. Owners can photograph a delivery invoice and verify pricing immediately — no need to wait until you're back at the office.

How does wholesale supplier price creep affect retail margins?

Supplier price creep occurs when wholesale vendors gradually increase prices between agreed terms and actual invoices — sometimes as small as 0.5-1% per quarter. With retail profit margins averaging 3-10%, a 2% undetected wholesale price increase on $500,000 annual inventory purchases costs $10,000 per year. BCG research confirms suppliers raise prices 5-8% when extended payment terms create the opportunity for quiet adjustments. Without systematic invoice comparison, these increases compound silently.

What wholesale invoice formats can AI comparison tools handle?

TRO Matcher processes 8 formats: PDF, PNG, JPEG, WebP, HEIC (iPhone photos), CSV, DOCX, and XLSX. Whether you receive wholesale invoices by email, through supplier portals, or as paper copies you photograph with your phone, the AI extracts pricing data with confidence scores on every field so you know exactly which items need manual review.

Is retail invoice data exportable and GDPR compliant?

Yes. TRO Matcher is fully GDPR compliant including Article 20 Data Portability. Export all your wholesale invoice data, supplier comparisons, and extracted pricing in CSV or PDF format at any time. CSV exports are compatible with QuickBooks, Xero, and other retail accounting software for direct import. No export fees and no vendor lock-in — see all plans.

What is the ROI timeline for retail invoice comparison software?

Most retailers see positive ROI within the first month. Based on average time savings of 4+ hours weekly on invoice processing, plus 2-5% cost reduction from catching pricing errors, even the Starter plan at $19/month pays for itself many times over. A retailer spending $40,000 monthly on wholesale inventory typically identifies $800-$2,000 in monthly savings. Start your free trial — no credit card required — and see the results for yourself.

Sources and Methodology

This analysis is based on:

- National Retail Federation: Retail shrinkage research and Impact of Theft & Violence 2025 report — vendor fraud and administrative error categorisation

- Boston Consulting Group: Research on supplier payment terms and hidden price increases (2024)

- U.S. Census Bureau: Monthly Wholesale Trade reports for wholesale market sizing ($11.9 trillion, 2026)

- Procurement Tactics / IHL Group: Inventory management statistics — carrying costs, accuracy rates, and shrinkage data

- Shopify / Capterra / NetSuite: Retail inventory cost benchmarks, software pricing, and profitability analysis

- TRO Matcher Platform Data: Internal analysis of retail sector usage patterns and discrepancy detection rates

Bottom Line

Independent retailers lose thousands annually to wholesale supplier overcharges that a spreadsheet-based spot-check will never catch. With profit margins averaging 3-10% and inventory costs consuming 25-35% of total budget, the maths is clear: systematic AI-powered invoice comparison is not an overhead — it's margin protection.

"For every $500,000 in annual wholesale purchases, undetected pricing discrepancies cost retailers $5,000-$25,000 per year. AI-powered invoice comparison with TRO Matcher catches these discrepancies in minutes instead of hours, turning invoice verification from a back-office burden into a profit centre for independent retailers."

Ready to find out what your suppliers are actually charging? Start your free trial — no credit card required, 10 free uploads and 5 comparisons included. Upload your first wholesale invoice and see what the AI finds.

For higher volume needs, see pricing plans starting at $19/month.

See What Your Wholesale Suppliers Are Really Charging

Start FreeWritten by

TRO Matcher Team

Product & Invoice Automation Experts

See What Your Wholesale Suppliers Are Really Charging

Upload a wholesale invoice and get AI-powered price analysis in 60 seconds. Free to start — no credit card required.

Start Free